HomeV3

Professional Quant Based Trading Strategies

Putting the trading odds in your favor.

Are you searching for professionally built trading strategies?

Do you want to save time finding the best trades?

- Professionally built quant based trading models

- These strategies will change the way you trade

- Designed by professional traders with a combined 35 years of trading experience and author of multiple of trading books

Best Strategies In 2023

| Volatility Trend Trader | VIXY/SVXY (1) | WTD: 3.53 | MTD: 6.75 | YTD: 51.08 |

| Volatility Trend Trader | SVXY Only (3) | WTD: 3.53 | MTD: 8.00 | YTD: 38.47 |

| Tech Comets | Halley (1) | WTD: 0.72 | MTD: 10.92 | YTD: 34.00 |

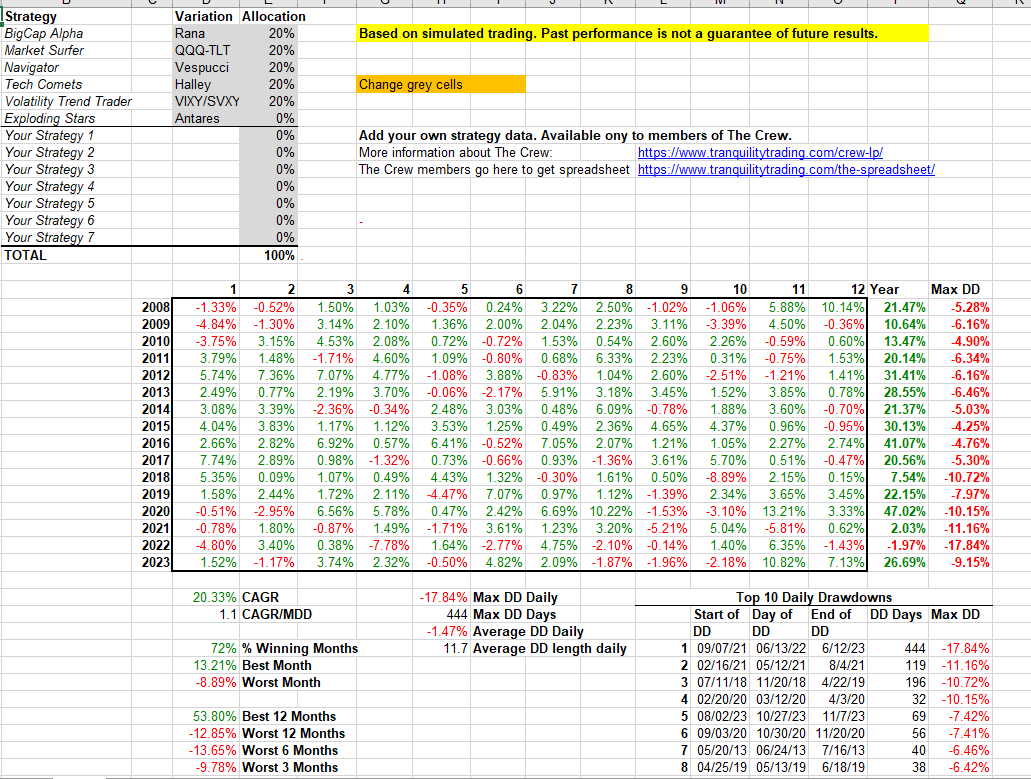

Create your ultimate portfolio using our strategies

Click here to create your custom portfolio!

Tranquility Trading Spreadsheet trades are available as individual subscriptions or by joining my private trading club The Crew

The Crew

An elite community of traders sharing ideas, finding trades, and creating strategies so you can profit.

- Signals to all Tranquility Trading strategies listed below

- Research and rules to strategies available only to The Crew members

- Private forum to connect and share ideas with other traders

- Trader's College presentations to learn more about specific area of trading

Community

Everyone trades better with friends

Strategy Vault

Profitable trading strategies just for you

Market Commentary

Big picture analysis of the markets

Trader's College

Invest in your trading education

Best Strategies This Year

| Tech Comets | Halley (1) | WTD: 0.29 | MTD: 16.39 | YTD: 31.18 |

| Tech Comets | Hyakutake (2) | WTD: 0.43 | MTD: 10.33 | YTD: 17.75 |

| Tech Comets | Shoemaker (3) | WTD: -0.87 | MTD: 9.09 | YTD: 14.70 |

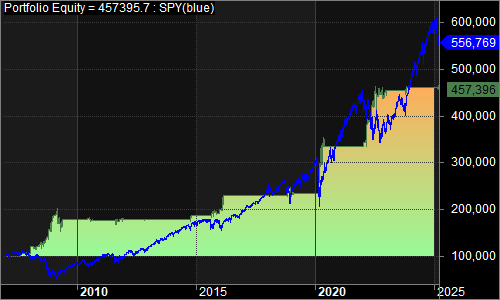

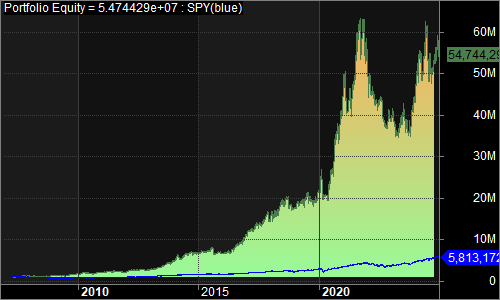

Tech Comets

- Trades only NASDAQ 100 stocks

- Average annual returns over 20%

- Winning trades with over 20% profit are common

- Can be traded once a week

Easy

Just takes 5-10 minutes each day. Or only once a week.

Equity Growth

20% a year growth over the past 10 years with even 2008 far outperforming the overall market

Minimal downside

In our simulated testing, this strategy tend to have smaller drawdowns than the market

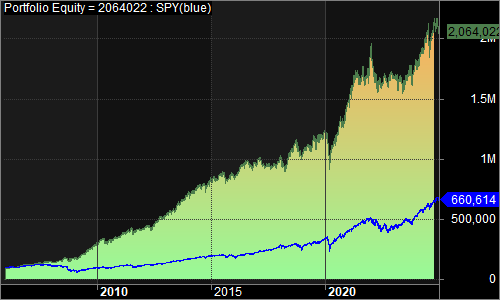

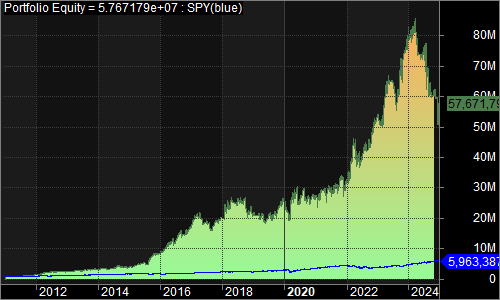

Volatility Trend Trader

- Trades only 2 ETFs (VIXY/SVXY)

- Average Annual Return over 30%

Easy

Just takes 5-10 minutes each day.

Equity Growth

Makes money in Bull and Bear markets

For Advanced Traders

The strategy is uncorrelated with the SPY

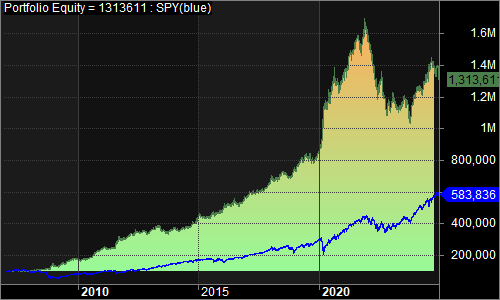

Big Cap Alpha

- Trades only S&P 100 stocks

- Compounded annual growth rate is better than the S&P 500 index

- No intra day market watching. Orders are placed outside of market hours

Easy

Just takes 5-10 minutes each day.

Equity Growth

Outperforming the overall market using S&P 100 stocks only

Minimal downside

In our simulated testing, this strategy has returns greater than drawdowns

Exploding Stars

- Shorts Russell 3000 stocks

- Is consistently profitable during bear markets

- No intra day market watching. Orders are placed outside of market hours

Easy

Just takes 5-10 minutes each day.

Equity Growth

Grow equity during bear markets

Minimal downside

Reduce your total portfolio drawdowns by adding this strategy

The Researchers

Cesar Alvarez

Cesar is well known in the quant community from his trading blog, Alvarez Quant Trading, where he shares his trading insights and research. He also consults with traders to test their trading ideas and help them improve their current strategies. From 2004 to 2013, Cesar was the Director of Trading Strategies at TradingMarkets.com and Connors Research. Cesar has also developed many strategies for private equity funds, is the author of multiple books on trading, and — in a former life — was a Software Engineer on the early versions of Microsoft Excel. After so many years developing well over 100 different methodologies, Cesar, like many true masters of his profession, has come back to the point of ultimate simplicity and efficiency as the best sustainable approach to active trading.

and Steven Gabriel

Steven has an extensive history trading equities, options, futures, and volatility. For the past 13 years he has been a quant-based trader, working alongside Cesar on research for 100’s of different ideas, concepts, strategies, and systems. Steve is also an Emergency Room physician. But he only practices medicine half-time now, because his success in trading financial markets.